The Ultimate Landlord Calculator

Today, I want to talk to you about something that can make life easier for landlords, both new and experienced. I’m talking about the ultimate landlord calculator – a tool that can help you make informed decisions about your property investments.

With anything financial it is vital that you always seek independent financial advice when making decisions about your rental properties. The Ultimate Landlord Calculator is just a tool to help you think about things prior to discussing them with your financial advisor.

What is the ultimate landlord calculator?

The ultimate landlord calculator is a free Excel spreadsheet that includes five different tools designed to help landlords manage their properties more effectively.

The tools included in this calculator are:

- Yield Calculator – helps you calculate the rental yield of a property by taking into account the property value and the annual rental income.

- Quick Property Budget – helps you forecast the revenue and expenses involved in owning and maintaining a property, including mortgage payments, insurance, taxes, and repairs.

- Rent Churn Calculator – helps you estimate the costs associated with tenant turnover, such as advertising, cleaning, and repairs. It enables you to compare different scenarios.

- Rent Estimating Guide – helps you estimate how high you should set the rent for your rental property by taking into account the features of your rental property compared to what you think the features are for other rental properties nearby.

- Cashflow Forecast – helps you forecast the cashflow of up to five different properties, taking into account all income and expenses.

Why is the ultimate landlord calculator useful?

The ultimate landlord calculator is useful because it provides landlords with a range of tools that can help them make informed decisions about their properties. For example, the yield calculator can help you determine whether a particular property is likely to generate a good return on investment, while the quick property budget can help you estimate the ongoing expenses of owning and maintaining the property.

The rent churn calculator can help you understand the costs associated with tenant turnover, which can be significant, while the rent estimating guide can help you determine how much rent to charge for a particular property based on its features and benefits to the tenant.

Finally, the cashflow forecast can help you plan your finances and ensure that you have enough money to cover all your expenses, including mortgage payments, taxes, and repairs.

As a famous person once said: “By failing to prepare, you are preparing to fail.” – Benjamin Franklin

In the context of property management, this quote is especially relevant. If you don’t have a good understanding of the costs and benefits associated with owning and maintaining a property, you are likely to run into problems down the road. The ultimate landlord calculator can help you prepare for these challenges by providing you with the tools you need to make informed decisions.

How to use the ultimate landlord calculator

Using the ultimate landlord calculator is straightforward. All you need to do is download the Excel spreadsheet and open it in Excel (or another spreadsheet program that can read Excel files). Once you have the spreadsheet open, you can use any of the five tools included in the calculator. Instructions are provided in the calculators to help users.

Let’s take a closer look at each of the tools and how to use them.

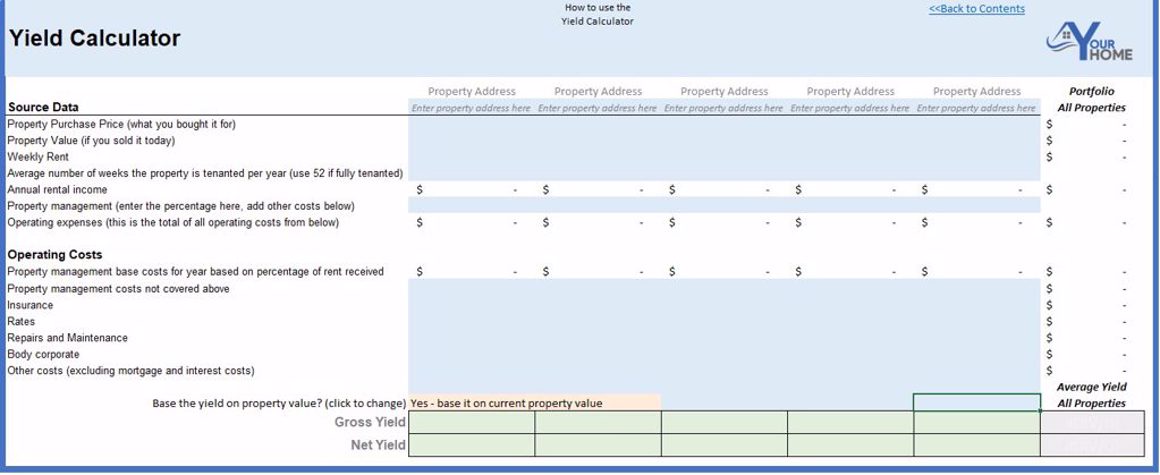

Yield Calculator

The yield calculator is a simple tool that helps you calculate the rental yield of a property. To use this tool, you will need to enter the following information:

- Property purchase price

- Property current value

- Weekly rent

- Property costs

Once you have entered this information, the calculator will automatically calculate the rental Gross Yield and also the Net Yield, these will be displayed on the screen.

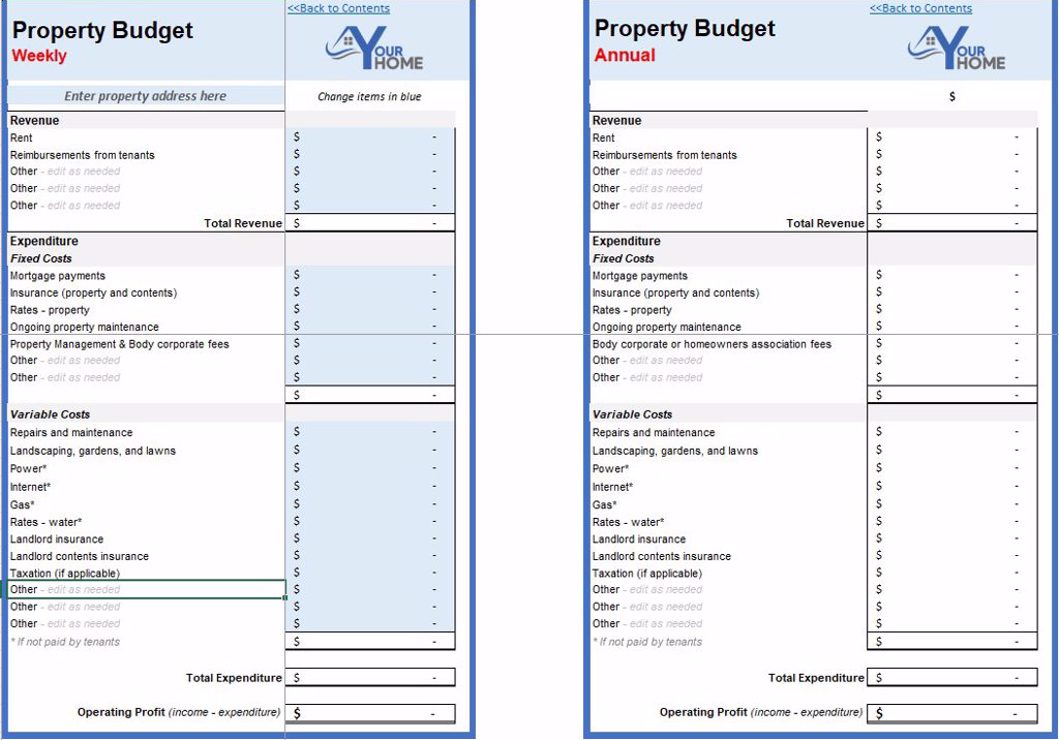

Quick Property Budget

The quick property budget is a tool that helps you estimate the revenue and expenses of owning and maintaining a property. To use this tool, you will need to enter the following information:

- Weekly rent

- Mortgage interest rate

- Property taxes

- Insurance

- Repairs and maintenance

- Property management fees

Once you have entered this information, the calculator will generate an annual budget to summarise the overall return ‘Operating Profit’ from the property. If you want more detail you can use the ‘Cashflow Forecast’ which is included in the same calculator spreadsheet.

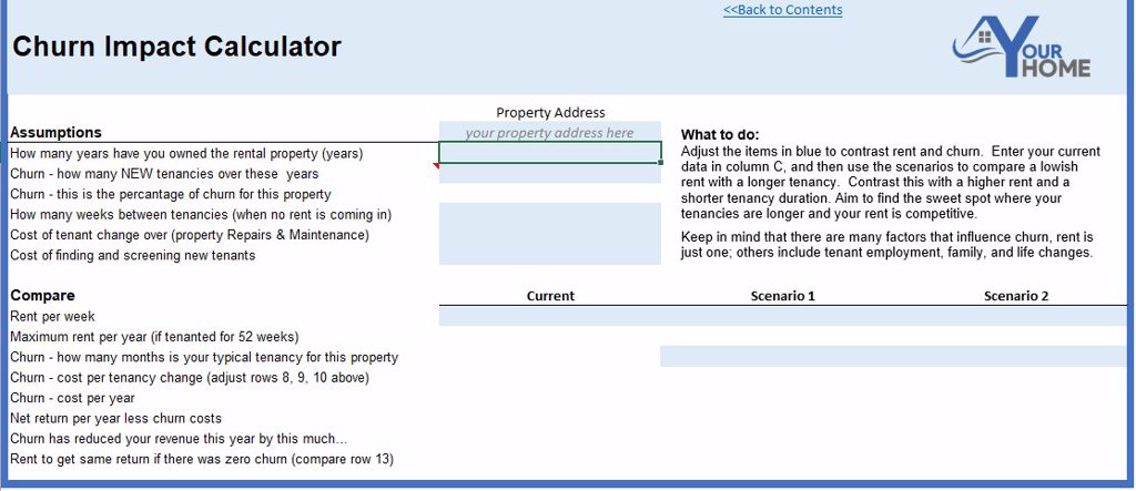

Rent Churn Calculator

The rent churn calculator is a tool that helps you estimate the costs associated with tenant turnover. To use this tool, you will need to enter the following information:

- Average length of tenancy

- Weekly rent

- Advertising costs

- Cleaning costs

- Repairs and maintenance costs

Once you have entered this information, the calculator will enable you to contrast three different tenancy churn scenarios and see what the impact is on your total returns, the total cost of tenant turnover will be displayed it on the screen.

This tool is ideal for comparing the impacts of different rent levels on total return while taking into account the costs of tenant churn or tenant turnover.

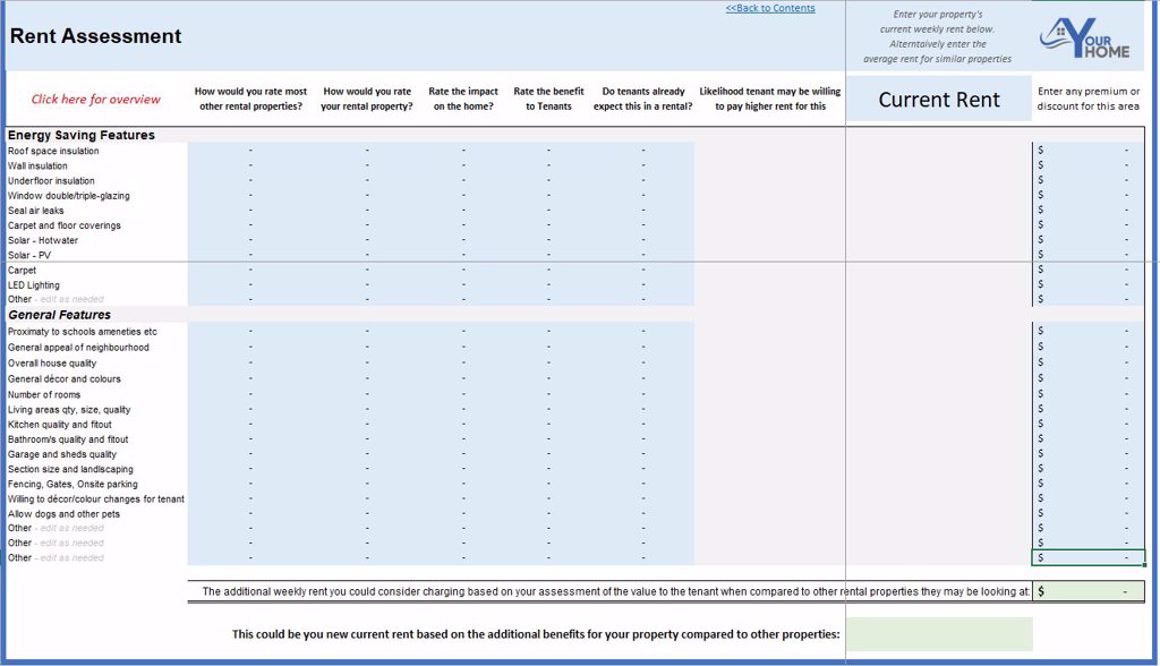

Rent Assessment Guide

The rent assessment guide is a tool that helps you determine whether you could charge a higher rental for your property compared to other rental properties in your area. This tool assumes that you have obtained an ‘average’ rent for other properties in the area, there are many websites that provide this high level info.

What we do differently in this calculator is cater for the attributes in your rental property that are unique and that may justify an increase in the rent that you charge to new tenants. This calculator enables you to add some structure and robustness to your ‘gut-feel’ thoughts on what the rent should be. It’s great for those self-managing to get more confidence on rent levels and also great for Property Managers needing to justify their recommended rent levels.

To use this tool, you will need to enter the following information:

- The current total rent.

- Information about the attributes of most other rentals in your area.

- How you would rate your own rental property against these attributes.

- The impact of these attributes on the home and the benefit to tenants, and whether the tenants already expect these benefits.

- The premium or discount you could expect for features and attributes your rental property has compared with others.

Once you have entered this information, the calculator will give you an indication of those areas where an increase in rent could be justified. You can then add some dollar-amounts to each aspect and end up with a total.

This guide also includes the ability to put a value on the energy saving features of your rental. You can model the impact of adding energy saving features and determine whether tenants would get value for these features… and then you can add a value.

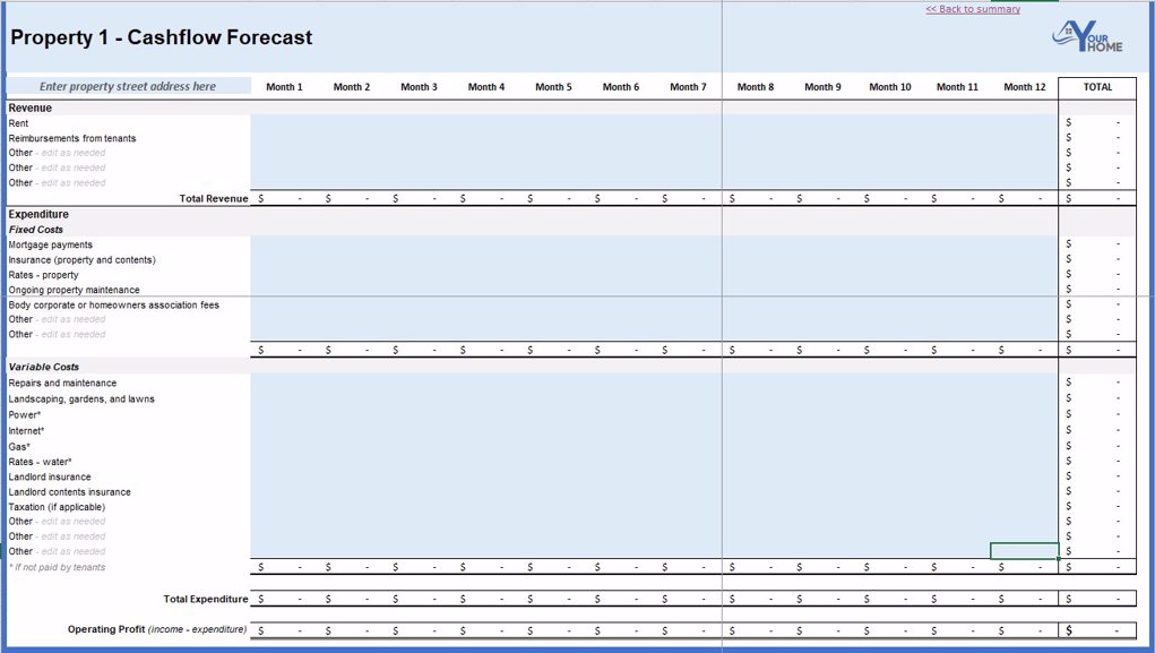

Cashflow Forecast

The cashflow forecast is a tool that helps you forecast the cashflow of up to five different properties. To use this tool, you will need to enter the following information:

- Property name

- Purchase price

- Mortgage details (e.g., interest rate, loan term, down payment)

- Monthly rental income

- Monthly expenses (e.g., taxes, insurance, repairs)

Once you have entered this information, the calculator will generate a cashflow forecast that shows you how much money you can expect to make (or lose) each month from each property.

Why the ultimate landlord calculator is a must-have for landlords

The ultimate landlord calculator is a must-have for landlords because it provides a range of powerful tools that can help you make informed decisions about your properties. By using the calculator to estimate rental yields, ongoing expenses, tenant turnover costs, and rental income, you can gain a better understanding of the financial implications of owning and managing a property.

Moreover, the cashflow forecast tool can help you plan your finances and ensure that you have enough money to cover all your expenses, both expected and unexpected. With this tool, you can avoid running into cash flow problems that could put your investment at risk.

In conclusion

Owning and managing rental properties can be a challenging endeavour, but with the ultimate landlord calculator, you can make informed decisions and plan for success. This free Excel spreadsheet includes five different tools designed to help you estimate rental yields, ongoing expenses, tenant turnover costs, rental income, and cash flow.

So, whether you’re a new landlord looking to make your first investment or an experienced landlord managing a portfolio of properties, the ultimate landlord calculator is a must-have tool that can help you succeed.

As the famous investor and business magnate Warren Buffett once said, “Risk comes from not knowing what you’re doing.” With the ultimate landlord calculator, you can eliminate the risk by knowing exactly what you’re doing and making informed decisions that can help you succeed in the competitive world of property investment.