8 Steps to Boost Rental Yield On Your Investment Property (How Much Rent Should You Charge?)

Having a healthy and consistent rental yield on your investment property goes hand in hand with how much rent you charge and, of course, how you manage your real estate asset..

In this comprehensive guide, you will learn how to estimate your income goals, rental yield, ROI, how to succeed at self-managing a rental, and more.

Table of Contents

- Decide what your rental property goals are

- Decide what level of tenant turnover or ‘churn’ you are willing to accept.

- Determine the current market rent for a property like yours

- Determine your running costs of the property

- This is like a cost-plus model. This will set the minimum rent you should charge.

- Determine your return on investment

- Determine your rental property yield

- Decide whether you wish to be a self-managing property owner

- Factor in the costs of the property management company if relevant

- Or the cost of self-managing software (a lot lower cost)

- Decide how quickly you want occupation of your property

- Carry out all relevant tenant checks and consider being more negotiable on lower-risk tenants.

1- Rental Property Goals

Is your rental property (or properties) a business where your goal is to maximise rental yield and the return on your investment? Do you view lower rents as leaving money on the table? Do you deliberately make your decisions purely as business decisions, and what is best for long-term profitability and gain?

If you answered ‘Yes’ to these questions, there is a good chance that your main goal is ‘maximised return’ or something similar.

However, do you see yourself as providing housing to people that need it? Would you be willing to leave a little money on the table if you thought it would make a difference for your tenants? Do you sometimes spend money on your property for the benefit of the tenant rather than purely for the benefit of your rental business? Do you make concessions for the tenant to cater for their needs?

If you answered ‘Yes’ to these questions, you may still have the goal to maximise your return but, you have the added dimension of being ‘tenant focused’ also.

From my own personal experience, the latter approach can often be less stressful and also more rewarding.

A maximum return approach can become stressful when you start comparing returns with those of other investors when you realise that other properties out there give better returns…or maybe when you discover some tenants are expensive to ‘maintain’.

3 – Current market rent for your rental property

The best place to start for current market rent for your rental property is the Tenancy Services website or an industry report such as those from Domain.com.au. These sites will give a rough guide to the going rates in various cities etc. The Tenancy Services site also provides lower, middle, and upper quartile rent for different numbers of bedrooms. These sites will give you a good high-level overview but it always comes down to finding a suitable tenant that is prepared to pay the rent you are asking.

Does your property have the ‘x-factor’?

If your home has the x-factor you can ask for more rent.

Below is a list of x-Factors that will typically demand a premium rent:

Hard to change x-factors

- Good location

- View &/or privacy

- Street appeal

- Parking

- Amenities – Proximity to schools, shops, workplaces etc

- Feng shui and indoor-outdoor flow

- Condition and fit-out of bathrooms, kitchen, etc.

Easier to change x-factors

- Pets allowed

- Décor, colours, condition of the interior (and, to a lesser extent, the exterior).

- Furnished

- Fencing (for children and or pets).

- You – How do you come across as Landlord.

- Property Managers – Some have better reputations than others.

- There are many others

Let’s look closer at the easy-to-change x-factors that can impact how much rent to charge and your rental yield.

Should you allow pets?

Pets, as a general rule, increase the level of wear and tear on a house, but that is only part of the story. If you allow pets (within certain guidelines) you are likely to attract tenants that have been excluded from other properties – purely because they have pets.

These tenants will often be willing to pay a little more. They are also likely to stay longer and be more family-focused. You may find you need to recarpet and repaint slightly more often, but in the big scheme of things, these are not massive costs.

Let’s say the replacement of carpets needs to happen after five years due to pets when it would have, otherwise, been seven years. Now factor in that you can probably increase rent by 5-10% by allowing pets, and that your tenant churn rate will possibly be lower and your rental yield higher… there’s not a lot in it.

Should you allow tenants to decorate?

Would you be willing to paint one or two rooms in colours that your tenants like? This is a very simple yet powerful indication that you, the Landlord, care about your tenants. They will be willing to pay more for a property that has a caring landlord.

Should you furnish the rental property?

Why not consider semi-furnishing the property with some semi-antique bookshelves or cabinets from an op shop; antiques are significantly less expensive these days. Alternatively, fully furnish the property and set the rent higher. The payback on the furniture will be quicker than you think.

Should you fence your rental property?

Families with young children and/or dogs will greatly appreciate a fenced section with a gate. A fence can be a simple way for practical DIY landlords to add value to a property. They can be constructed with tenants in the property, there are minimal compliance and regulatory requirements for fences and are easy to price up before the job starts.

Should you be a kind landlord?

Ok! I know that all landlords are kind… but did you know that being a kind landlord can increase your rental yield! Seriously. Many tenants will be willing to pay a little more if they have ‘good vibes’ about the landlord. Many tenants will also take more care of your property if they know you care about them. Being kind does not mean you have to be a pushover – you can be firm when needed!

4 – Determine your running costs

The main rental yield on your investment property will, obviously, be rent. You may wish to also budget for proposed or regular rent increases.

When working out the running costs of your rental property, the main items to consider are:

- Mortgage principle – This is not really a cost of renting. It is the cost of owning a rental property.

- Mortgage interest (also determine whether this is tax deductible).

- Rates (use last year’s, plus a percentage increase)

- Other costs that are not being passed onto the tenant. These can include water rates, body corporate fees, and maybe some utilities etc.

- Insurance (use last year’s, plus a percentage increase, also check for policy changes which may increase this cost).

- Property management company fees and costs (if used).

- Self-management costs such as rental property management software subscription.

- Maintenance – For example, annual exterior wash, annual heat pump servicing, and pest control.

- Repairs – this one is hard to forecast. Some recommend 0.5-2.0% of the value of the house/dwelling (excluding the land). Others recommend 8-10% of the annual rental yield.

- Compliance costs – In many cases, these can be included in R&M but it is good practice to separate these costs out if they are irregular or one-off costs.

- Reserves – Consider the need to set aside money that may be needed for a major expense that may arise in the future. This could be recarpeting, repainting, insulation, section work, etc.

Other costs you should retain funds for include:

- Tenanting costs – If you need to find new tenants.

- Pre-tenant repairs and maintenance - This includes items that need to be repaired or replaced in order to present a more appealing property for new tenants. As a minimum, this would be a full commercial clean.

- Insurance excess – If there is damage done to the property unless the tenant is liable you will need to cover the excess.

- Vacancy costs – The loss of revenue for the period between when existing tenants leave and new ones arrive. These costs can be incurred if there is damage that requires the tenant to move out or at least have their rent significantly reduced. In some cases, these costs can be covered via insurance.

- Tax – Discuss with your accountant how much of the rental yield you should be setting aside each week for tax.

Determine your return on investment: Rental yield, gross yield, and net yield

The crucial thing to determine is whether you are making more money than you are spending… over the long term. There are two numbers you can use:

Gross rental yield

- Multiply your weekly rent by 52 weeks to get the total revenue.

- Divide the total revenue by your property’s value (what you bought it for, or what you think it is worth now).

- You should end up with a number somewhere between 3.0 – 10.0% higher is better.

- Here’s a ‘Rental Yield Indicator‘.

Net rental yield

- Multiply your weekly rent by 52 weeks to get the total revenue.

- Subtract your direct costs for the property to get the total net revenue.

- Divide the total net revenue by your property’s value (what you bought it for, or what you think it is worth now).

The crucial thing to determine is whether you are making more money than you are spending… over the long term.

There are two numbers you can use:

Net rental yield

Gross rental yield

5 – What is a good rental yield

Rather than looking at what a good rental yield is, let’s look at what a poor yield is. Think of the rental yield as your reward for taking the risk of running a rental investment property.

The lower the rental yield, the less you are being paid for taking this risk. If your rental yield is lower than the interest (compounded) you would get from putting the value of your property in the bank as a term deposit, then you are not getting any benefit from owning a rental property and taking on the risk.

However, that is often far too simplistic as there are several other factors to keep in mind.

Rental property capital gain

In addition to the rental yield we worked out above, the total value of your property may be increasing due to capital gain. While this increase in the value of your property is not realised until you sell the property, this increased value could be apportioned over the years that you have owned the property.

For example; if you sold your property for $100,000 more than you paid for it 5 years ago, you essentially earned an additional 20k on top of the rent you made each year. This may well be enough of a reward for the risk you took in purchasing and running the rental property. When compared to putting your money on deposit in the bank – this capital gain becomes very appealing!

Leveraging your money

Another factor to consider is that by purchasing a property you can ‘leverage’ your money to buy something more expensive than the money/cash you have in the bank. For example, you may be able to purchase an $800,000 property for $400,000 with $400,000 being leveraged or borrowed. So a more accurate comparison could be to base your rental yield equation on the amount of cash you have invested rather than on the value of your property.

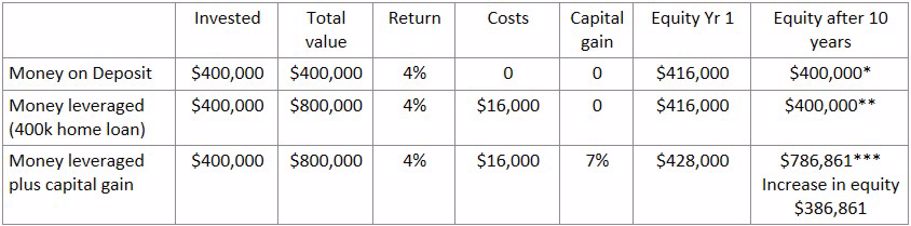

Let’s take a look at two scenarios…

Scenario 1

In this scenario, we are putting our money in a bank deposit. We’re investing the 400k in a bank term deposit at 4%. This will give us a 4% yield or about $16,000 per year less tax. This is considered to be the risk-free rate of return as your money is very safe.

Scenario 2

In this scenario, we are going to use the same 400k to purchase an 800k property with a 400k mortgage. There is a lot more risk in this scenario as interest rates may go up, the house may burn down, the tenants may not pay the rent, etc.

- If the Gross Rental Yield was the same as having the money on deposit, i.e. 4%, it looks like there is no benefit in taking on this higher level of risk. However, since our property is worth 800k the 4% return is bringing in $32,000 (i.e. 4% x $800,000 = $32,000).

- What this means is that you have an additional $16,000 to do things like pay interest, maintain the property, pay insurance, etc. This may or may not be enough to reward you for your risk.

Let’s take a longer view of how this could pan out.

Leveraged money PLUS capital gain

In the scenario above, we saw the benefit of leveraged money, but what if we added the capital gain as well. Let’s look at the numbers in year one versus year ten.

- * Bank deposit interest rates are not usually affected by inflation. Sometimes a slightly better rate can be obtained for longer-term deposits. In this example, we have not compounded the interest.

- ** The equity here is based on an interest-only home loan. Typically a portion of the principal is repaid which will increase the costs and also increase your equity.

- *** If principle was also being paid as part of the loan, the equity would be higher. Use this comprehensive calculator or the downloaded spreadsheet from this site for your own use.

Rental property management is a compelling solution for landlords that choose to leverage their money to purchase properties with good capital gain potential. With good capital gain, the overall viability of rental properties can be very good.

6 – Self-Managing Landlord

Most property owners will ask themselves: “can I, and should I self-manage my rental property, or should I use a property manager?” Here are some of the pros and cons of each approach.

When you should be a self-managing landlord

- You have a vested interest in your property and will be highly committed to making it work.

- It ensures that you are closely monitoring what is happening with your property.

- The running costs of your rental property are lower… often by 6-12% (Property Management companies charge somewhere between 6% and 12% of rent takings).

- You can work with the tenants in a less ‘transactional’ way.

- There are rental management software apps (such as Your Home Our Home) that make it easier to self-manage your property affordably.

- If your tenants are good and long-term, self-managing is easy and rewarding.

- If there is a social-good component to your rental properties where you want to be more engaged with the tenants in your properties.

When you should use a property manager

You should use a property manager when:

- When you (or your partner) don’t have the time, skills, knowledge or inclination to manage it yourself.

- When you want minimal contact with tenants.

- When the property is too far away to easily manage.

- When you want your property managed in a highly transactional way…like a business.

When you are willing to pay 6-12% of the rental yield to a third party to eliminate many of the hassles of owning a property.

7 – Decide how quickly you want occupation of your property

A general principle is that the lower the rent… the more tenants will apply. The main factors to think about are:

Higher Rents

- Will narrow down the applicants to those willing to pay – this is usually a good thing

- Will draw in more professionals and high-earning applicants – this is usually good

- This will result in applicants with higher expectations for the quality of the property – this is not so good

Lower Rents

Will get a lot more applicants, which means:

- More applicants to screen and interview – which can be a hassle

- More applicants to choose from – it can be good to find tenants with similar ‘chemistry’ to you.

This may result in more applicants that are on benefits of some type, which means:

- In some cases, a government agency may be the one paying the rent, which can be great for payment reliability.

- Some applicants may greatly appreciate a modest rent to help them get affordable housing.

Test the market to see if you get responses from good tenants for the money you are asking. You may find that it works to have a slightly higher asking price and then be willing to negotiate the price with the preferred tenants.

Carry out all relevant tenant checks before making the final call on rent and tenants.

There are a range of third-party sites that provide tenant placement and tenant checking services. You can also very easily carry out your own checks although more work is required to do it on your own.

We think it is a good idea to be more negotiable on rent for tenants that you think are a good fit for your rental property.

Summary

The main drivers of rental pricing are:

- The quality of the property and its location to amenities.

- The goals and motivation of the landlord – the rental property owner.

- The costs related to the rental property vs. the returns, which may be direct via rent or a combination of rent and capital gain.

- The quality of the tenants.

- The level of tenant turnover that landlords are prepared to accept.

- The market value rate for rent in the area.

Other factors can also impact how much rent you should charge, but this article has walked you through most of them! We’ve also shown you how to leverage your options to boost your rental yield in a way that feels good, ethical, and where everybody wins.

Use this guide to guide your rental property decisions. We recommend getting advice from your accountant when you are close to finalising your proposed rent and forecasting your yearly rental yield. This becomes especially important if you are ‘highly geared’ with a large mortgage.